The Fundamentals of Decentralized Finance (DeFi): A Comprehensive Guide

Decentralized Finance, or DeFi, is transforming the financial world by removing traditional intermediaries like banks and offering financial services on open, blockchain-based platforms. This guide provides a clear, easy-to-understand overview of DeFi—covering its definition, key components, comparisons with traditional finance, major platforms, inherent risks and rewards, and the future innovations driving this revolution.

Table of Contents

Core Elements, Premier Platforms & Future Potential

What is DeFi? A Beginner’s Guide to Decentralized Finance

Core Components of DeFi: Lending, Staking, and Yield Farming Explained

DeFi vs. Traditional Finance: Understanding the Key Differences

Top DeFi Platforms and Protocols: A Comprehensive Overview

Navigating Risks and Rewards in the DeFi Ecosystem

Future Innovations in DeFi: Emerging Trends and Technologies

DeFi (Decentralized Finance) offers alternatives to traditional finance, including components like lending, staking, and yield farming, all aimed at improving accessibility and autonomy in financial services.

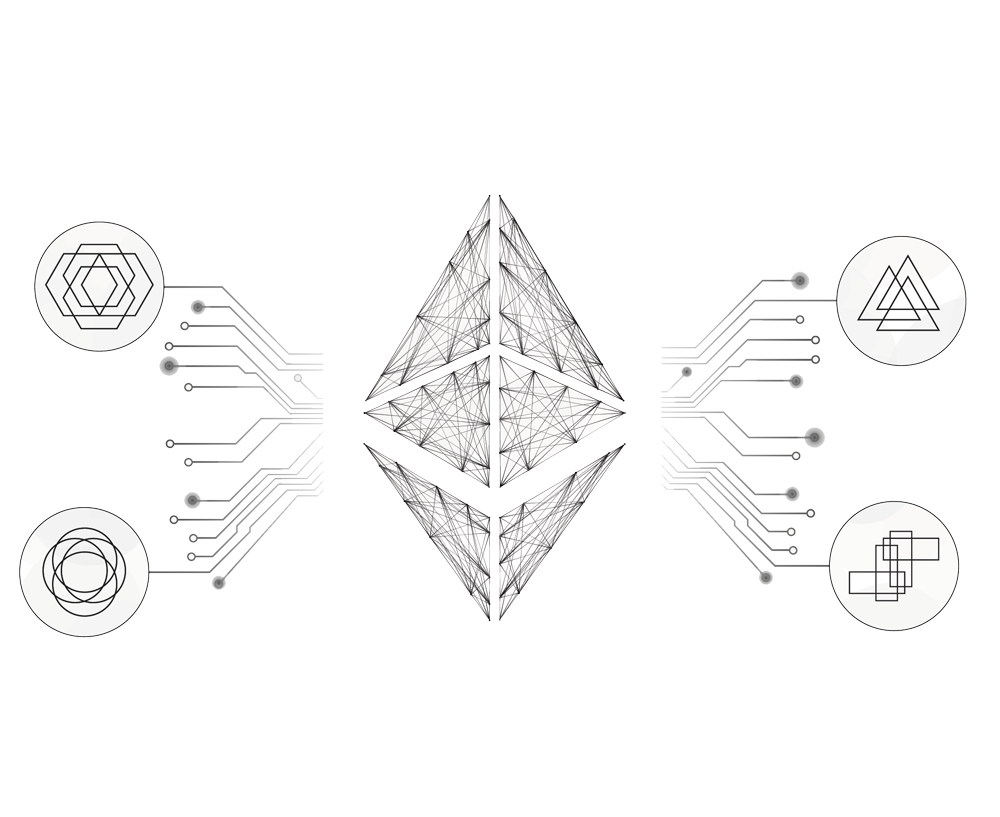

What is DeFi? A Beginner’s Guide to Decentralized Finance

Introduction to Decentralized Finance (DeFi)

DeFi is like “online banking without the bank.” Instead of using a bank or PayPal to send money or earn interest, DeFi lets you do these things directly with other people using apps built on the internet. No one owns or controls it—not even a company.

- No Middlemen: DeFi apps run on code, not a CEO or bank. Think of it like a vending machine: you put in crypto, and it automatically gives you a loan or interest.

- Works Everywhere: Use it from any country—all you need is internet.

- See Everything: Every transaction is posted online (like a public receipt), so no secrets.

Learn more about What is DeFi? A Beginner’s Guide to Decentralized Finance

Lending, Staking, and Yield Farming Explained

At the heart of DeFi are several core financial services that enable users to earn passive income, borrow funds, or participate in investment opportunities without a bank. These include:

Lending: Users can lend their assets and earn interest directly from borrowers.

Staking: By locking up assets in a network, users support its operations and earn rewards.

Yield Farming: This involves moving assets across different DeFi protocols to maximize returns.

Discover more about the Core Components of DeFi: Lending, Staking, and Yield Farming Explained

Key Differences from Traditional Finance & Exploring Leading Platforms

DeFi vs. Traditional Finance

The rise of DEXs is part of a larger shift from centralized finance (TradFi) to decentralized finance (DeFi). For a comprehensive historical and strategic perspective, check out: Traditional Banking vs. DeFi: The Rise of Decentralized Exchanges

Understanding the Key Differences

- Decentralization vs. Centralization: Traditional finance is centralized and controlled by banks and governments, whereas DeFi operates on decentralized networks.

- Accessibility: DeFi platforms are open to anyone globally, while traditional banking can be limited by geography and eligibility requirements.

- Transparency and Control: DeFi provides greater transparency, as all transactions are recorded on a public ledger, and users maintain control of their funds.

Top DeFi Platforms and Protocols

Numerous platforms are at the forefront of the DeFi movement, each offering unique protocols and services. Some of the leading names include:

- Uniswap: A decentralized exchange (DEX) that enables seamless token swaps via liquidity pools.

- Thorchain: A cross-chain liquidity protocol designed to facilitate interoperability across different blockchain networks.

- Aave: A lending platform that offers borrowing, lending, and innovative features like flash loans to optimize asset utilization.

- Maker: The backbone of the DAI stablecoin, empowering decentralized stable value creation within the DeFi ecosystem.

Explore detailed insights into Top DeFi Platforms and Protocols: A Comprehensive Overview

Risks , Security & Challenges

Risks and Rewards in the DeFi Ecosystem

While DeFi offers exciting opportunities, it also comes with its share of risks. Understanding these can help users make informed decisions:

- High potential returns through interest, rewards, and yield farming.

- Increased financial inclusion and innovation in financial products.

To mitigate these risks:

- Smart contract vulnerabilities that can be exploited by hackers.

- Market volatility and liquidity risks that may affect asset values.

- Regulatory uncertainties that could impact the broader ecosystem.

Future Innovations in DeFi

Decentralized Finance Trends and Technologies

The DeFi space is rapidly evolving, with new technologies and protocols emerging to address current limitations and expand possibilities. Future innovations include:

- Enhanced Interoperability: Developing systems that allow seamless interaction between different blockchain networks.

- Improved Security Protocols: More robust security measures to safeguard against hacking and fraud.

- Scalability Solutions: Innovations designed to handle higher transaction volumes efficiently.

- Broader Adoption: As more industries explore blockchain, DeFi could integrate further into mainstream finance.

Stay updated with Future Innovations in DeFi: Emerging Trends and Technologies

Most Common FAQ

DeFi, or Decentralized Finance, is a blockchain-based financial ecosystem that eliminates traditional intermediaries like banks, enabling peer-to-peer transactions and a wide range of financial services through smart contracts.

DeFi operates on decentralized networks with transparent, publicly verifiable transactions, in contrast to the centralized, institution-controlled systems of traditional finance that often involve higher fees and restricted access.

DeFi offers increased transparency, reduced transaction fees, global accessibility, and innovative financial services such as yield farming, staking, and lending, providing users with greater control over their assets.

Risks include vulnerabilities in smart contracts, market volatility, liquidity issues, and potential regulatory uncertainties, all of which users should consider and manage carefully.

Leading platforms include Uniswap for token swaps, Thorchain for cross-chain liquidity, Aave for lending and borrowing, and Maker, which powers the DAI stablecoin, each offering unique functionalities within the DeFi ecosystem.

Uniswap is a decentralized exchange (DEX) that uses liquidity pools instead of traditional order books, allowing users to trade tokens directly from their wallets while earning fees by providing liquidity.

Thorchain is a decentralized protocol that enables seamless, trustless asset exchanges between different blockchain networks, allowing users to swap cryptocurrencies across chains without relying on centralized intermediaries.

Aave stands out by offering innovative features such as flash loans—which provide collateral-free, short-term loans—as well as competitive lending and borrowing services that help users optimize asset utilization.

MakerDAO manages the DAI stablecoin through a system of collateralized debt positions, where users lock up crypto assets to generate DAI, ensuring its value remains closely pegged to the US dollar through automated governance mechanisms.

Begin by educating yourself about blockchain and DeFi fundamentals, set up a secure crypto wallet, and start with small transactions on reputable platforms like Uniswap, Aave, or Maker to gradually build confidence and experience.

Beyond trading and lending, DeFi enables yield farming, staking, decentralized insurance, synthetic assets, and decentralized governance, all of which empower users to participate in shaping financial services and products.

The future of DeFi is promising, with anticipated advancements in scalability, security, and interoperability between blockchains, as well as potential integrations with traditional finance, paving the way for a more inclusive and efficient global financial ecosystem.

Ready to take the next step?

Building a Better Trading Future

Provide a Trading Experience

The Experts Behind Your Success

Empowering Traders Worldwide

Extra Resources

Understanding Lending, Staking, and Yield Farming

In the rapidly evolving landscape of Decentralized Finance (DeFi), opportunities to earn passive income have taken center stage. Lending, staking, and yield farming are three key mechanisms that

Instaswap

February 18, 2025

What is DeFi: A Comprehensive Guide

In the fast-changing world of finance, a new term has popped up creating a lot of buzz and talk: DeFi, or Decentralized Finance. But what is DeFi, and